Stocks: Your Ownership Stake in a Company’s Success

Stocks represent a fundamental pillar of the modern financial system, offering individuals the opportunity to become partial owners of publicly traded companies. This ownership, while often intangible, carries significant weight in both personal finance and the broader economy. As we delve into the world of stocks, we’ll explore their nature, function, and impact, providing you with a comprehensive understanding of this crucial investment vehicle.

What Are Stocks?

Stocks, also known as shares or equity, are units of ownership in a company. When you purchase a stock, you’re buying a small piece of that company, becoming a shareholder. This ownership grants you certain rights and potential benefits, including:

- Voting rights at shareholder meetings

- A claim on the company’s assets and earnings

- Potential dividend payments

- The opportunity for capital appreciation if the stock’s value increases

It’s important to note that stocks represent residual claims on a company’s assets. This means that in the event of liquidation, stockholders are paid after bondholders and other creditors. This higher risk is balanced by the potential for higher returns compared to other investment types.

Types of Stocks

Not all stocks are created equal. There are several types of stocks, each with its own characteristics and potential benefits:

Common Stocks: These are the most prevalent type of stocks. Common stockholders typically have voting rights and may receive dividends, but they’re last in line for claims on assets if the company goes bankrupt.

Preferred Stocks: These stocks usually don’t come with voting rights, but they offer a fixed dividend that must be paid before dividends to common stockholders. Preferred stockholders also have priority over common stockholders in the event of liquidation.

Growth Stocks: These are shares in companies expected to grow at an above-average rate compared to other companies in the market. They typically don’t pay dividends, as the company reinvests profits to fuel further growth.

Value Stocks: These are shares in companies that appear to be undervalued by the market. They often pay dividends and may be less volatile than growth stocks.

Blue-Chip Stocks: These are shares in large, well-established companies with a history of stable earnings and reliable dividend payments.

Understanding these different types of stocks can help investors build a diversified portfolio that aligns with their financial goals and risk tolerance.

How Stocks Work

The stock market operates on a basic principle of supply and demand. When more people want to buy a stock (demand) than sell it (supply), the price moves up. Conversely, when more people want to sell a stock than buy it, the price falls. This dynamic creates the familiar ups and downs of stock prices that we see in financial news reports.

Companies issue stocks through a process called an Initial Public Offering (IPO). After the IPO, stocks are traded on secondary markets, such as the New York Stock Exchange or NASDAQ. These exchanges provide a platform for buyers and sellers to trade stocks efficiently.

Here’s a simplified overview of how stocks work:

- A company decides to go public and issues shares through an IPO.

- Investors buy these shares, becoming partial owners of the company.

- The company uses the capital raised to fund operations, expansion, or other business needs.

- As the company grows and becomes more profitable, the value of its shares may increase, benefiting shareholders.

- If the company pays dividends, shareholders receive a portion of the company’s profits.

- Shareholders can sell their stocks at any time on the stock market, potentially realizing a capital gain (or loss) based on the difference between their purchase price and selling price.

The Importance of Stocks in the Economy

Stocks play a crucial role in the overall economy, serving several important functions:

Capital Formation: By issuing stocks, companies can raise capital to fund growth, research and development, and other business activities. This influx of capital fuels economic growth and innovation.

Wealth Creation: Stocks provide a mechanism for individuals to build wealth over time. As companies grow and prosper, stockholders can benefit from capital appreciation and dividend income.

Economic Indicator: Stock market performance is often used as a barometer for overall economic health. Rising stock prices can indicate economic growth and optimism, while falling prices may signal economic concerns.

Corporate Governance: Through voting rights, stockholders can influence company decisions, promoting accountability and aligning management’s interests with those of shareholders.

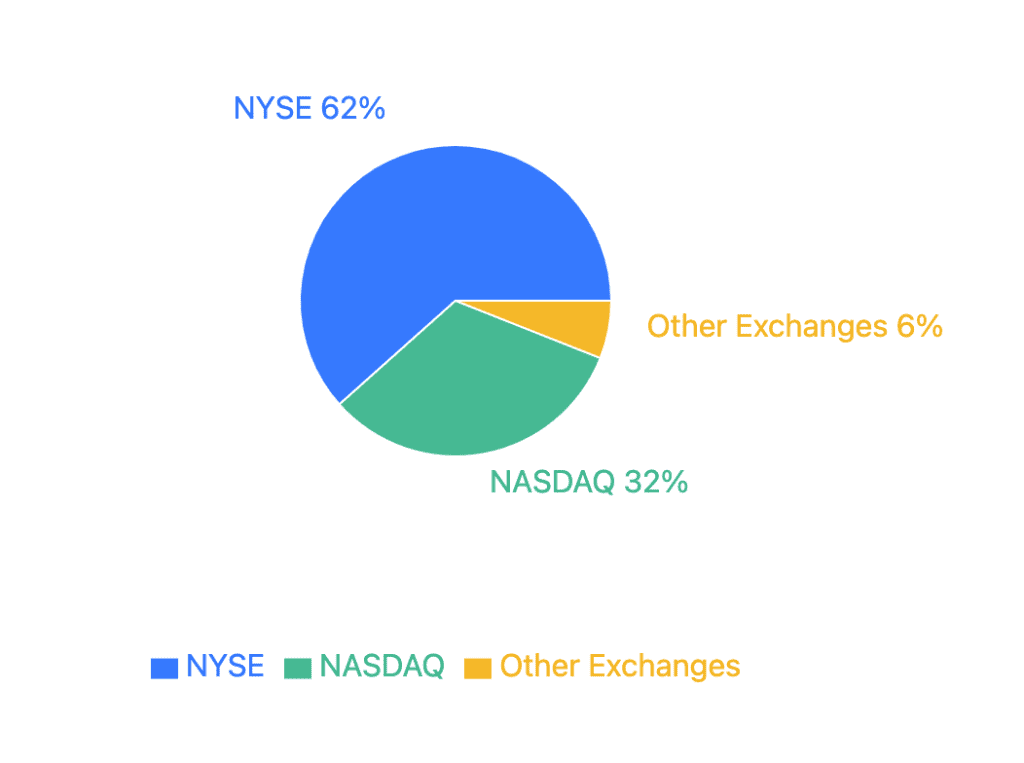

To illustrate the significance of stocks in the U.S. economy, let’s look at some key statistics:

This chart shows the distribution of stock market capitalization across major U.S. exchanges, highlighting the dominance of the New York Stock Exchange (NYSE) and NASDAQ.

Factors Affecting Stock Prices

Stock prices are influenced by a myriad of factors, both internal to the company and external market forces. Understanding these factors can help investors make more informed decisions:

Company Performance: A company’s financial health, earnings reports, and future growth prospects directly impact its stock price. Positive earnings surprises often lead to stock price increases, while missed expectations can cause declines.

Industry Trends: The performance of a company’s industry sector can affect its stock price. For example, technological advancements or regulatory changes can impact entire industries.

Economic Indicators: Macroeconomic factors such as GDP growth, inflation rates, and employment figures can influence stock prices across the market.

Interest Rates: Changes in interest rates can affect stock prices. Generally, lower interest rates tend to boost stock prices as they make stocks more attractive compared to fixed-income investments.

Geopolitical Events: Global events, such as political instability, trade disputes, or natural disasters, can create market uncertainty and impact stock prices.

Market Sentiment: Investor psychology and overall market sentiment can drive stock prices in the short term, sometimes leading to bubbles or crashes.

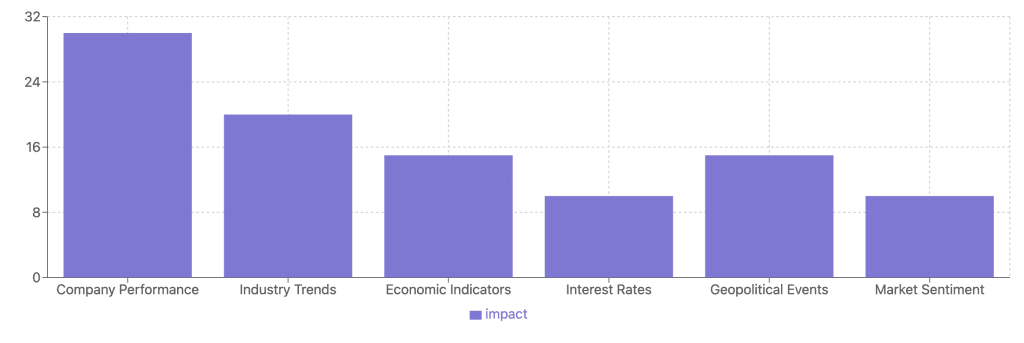

To illustrate how these factors can impact stock prices, let’s look at a hypothetical example:

This chart provides a visual representation of the relative impact of different factors on stock prices. While the exact percentages may vary depending on the specific stock and market conditions, it illustrates the multifaceted nature of stock price movements.

Investing in Stocks: Strategies and Considerations

Investing in stocks can be a powerful way to build wealth over time, but it’s important to approach it with a well-thought-out strategy. Here are some key considerations and strategies for stock investing:

Diversification: This involves spreading investments across different stocks, sectors, and even asset classes to reduce risk. The old adage “don’t put all your eggs in one basket” applies strongly to stock investing.

Long-Term Perspective: Historically, stocks have tended to provide higher returns over long periods compared to many other investment types. Adopting a long-term perspective can help investors weather short-term market volatility.

Research and Due Diligence: Before investing in a stock, it’s crucial to research the company thoroughly. This includes analyzing financial statements, understanding the business model, and evaluating the competitive landscape.

Dollar-Cost Averaging: This strategy involves investing a fixed amount of money at regular intervals, regardless of market conditions. It can help reduce the impact of market volatility on your investments.

Dividend Investing: Some investors focus on stocks that pay regular dividends, providing a steady income stream in addition to potential capital appreciation.

Growth Investing: This strategy involves seeking out companies with high growth potential, often in emerging industries or markets.

Value Investing: Value investors look for stocks that appear undervalued by the market, often using financial ratios and other metrics to identify potential bargains.

It’s important to note that no single strategy is universally superior, and the best approach often depends on an individual’s financial goals, risk tolerance, and investment timeline.

Risks and Challenges of Stock Investing

While stocks offer significant potential for returns, they also come with risks that investors should be aware of:

Market Risk: Stock prices can be volatile and may decline due to overall market conditions, even if a company’s fundamentals remain strong.

Company-Specific Risk: Individual companies may face challenges such as poor management decisions, competitive pressures, or industry disruptions that can negatively impact their stock price.

Liquidity Risk: Some stocks, particularly those of smaller companies, may be difficult to buy or sell quickly without affecting the stock price.

Currency Risk: For international stocks, changes in exchange rates can impact returns for investors holding stocks in foreign currencies.

Emotional Risk: The volatility of stock prices can lead to emotional decision-making, potentially causing investors to buy high and sell low.

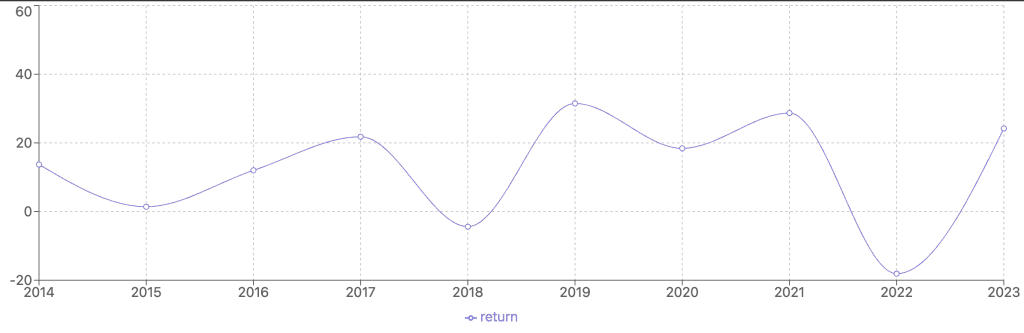

To illustrate the potential volatility of stock investments, let’s look at a hypothetical example of stock market returns over a 10-year period:

This chart illustrates the year-to-year variability of stock market returns. While the overall trend may be positive, there can be significant fluctuations from year to year, highlighting the importance of a long-term perspective when investing in stocks.

The Future of Stock Investing

As we look to the future, several trends are shaping the landscape of stock investing:

Technology and Automation: The rise of robo-advisors and algorithmic trading is making stock investing more accessible and efficient for individual investors.

Sustainable Investing: Environmental, Social, and Governance (ESG) factors are becoming increasingly important to investors, leading to the growth of sustainable and socially responsible investing options.

Fractional Shares: Many brokerages now offer the ability to buy fractional shares, allowing investors to own portions of high-priced stocks and further diversify their portfolios.

Global Market Access: Improved technology and regulatory changes are making it easier for investors to access international stock markets, offering greater diversification opportunities.

Artificial Intelligence and Big Data: These technologies are being used to analyze vast amounts of data, potentially leading to more informed investment decisions.

As these trends continue to evolve, they may reshape how individuals approach stock investing and interact with the stock market.

Conclusion

Stocks represent a powerful tool for wealth creation and economic growth, offering individuals the opportunity to participate in the success of companies around the world. While they come with risks, a well-informed and disciplined approach to stock investing can potentially lead to significant long-term rewards.

As you consider incorporating stocks into your investment strategy, remember the importance of thorough research, diversification, and aligning your investments with your financial goals and risk tolerance. Whether you’re a seasoned investor or just starting out, understanding the fundamentals of stocks and the factors that influence their performance can help you make more informed investment decisions.

In an ever-changing financial landscape, stocks remain a cornerstone of investment portfolios, offering the potential for growth, income, and a stake in the world’s most innovative and successful companies.

Disclaimer: This blog post is for informational purposes only and does not constitute investment advice. Investing in stocks carries risks, including the potential loss of principal. Past performance does not guarantee future results. Always conduct your own research and consider consulting with a financial advisor before making investment decisions. While we strive for accuracy, if you notice any inaccuracies in this post, please report them so we can promptly correct them.